Question:

How do I pinpoint the hottest zip codes in cities that have the strongest Master Scores?

Answer:

First and foremost, it’s important to recognize the limitations of “momentum” (aka “trends) and how/why it’s only a part of the equation.

To understand this better, make sure to check out the second half of this video: TAPS & STAR Tutorial video

With that said, the short answer to your question is you shouldn’t drill down to zip code level until you have evaluated and chosen a strong market at the metropolitan level.

Why do we recommend starting at the metropolitan level?

Simply because zip code “micro-markets” follow what’s happening in the overall city-level markets. Many investors think a hot micro-market in an otherwise flat or declining market is OK, but it’s not. And that’s because the zip code micro market will eventually equalize with the overall local market.

After all, a rising tide lifts all boats, and vice versa.

Therefore, you should only drill down to find hot zip code micro markets once you’ve picked the best metro market.

From there, you can find better zip code ‘micro-markets’ that will outperform other ‘micro-markets’ on a RELATIVE basis WITHIN the same overall market.

Keep in mind, it’s exponentially harder to score zip codes (i.e. – using STAR and TAPS indicators) because they are NOT a market. They are small pockets with relatively very few transactions; the small ‘sample size’ creates a lot of random noise with large variances from one period to another.

Fortunately, we’re developing and back-testing very complex scoring algorithms that’ll make things A LOT easier. We’re shooting to release the first zip code SCORING version (i.e. STAR and TAPS interpretation) in about two months.

In the meantime, here’s the quickest way to use the zip code data:

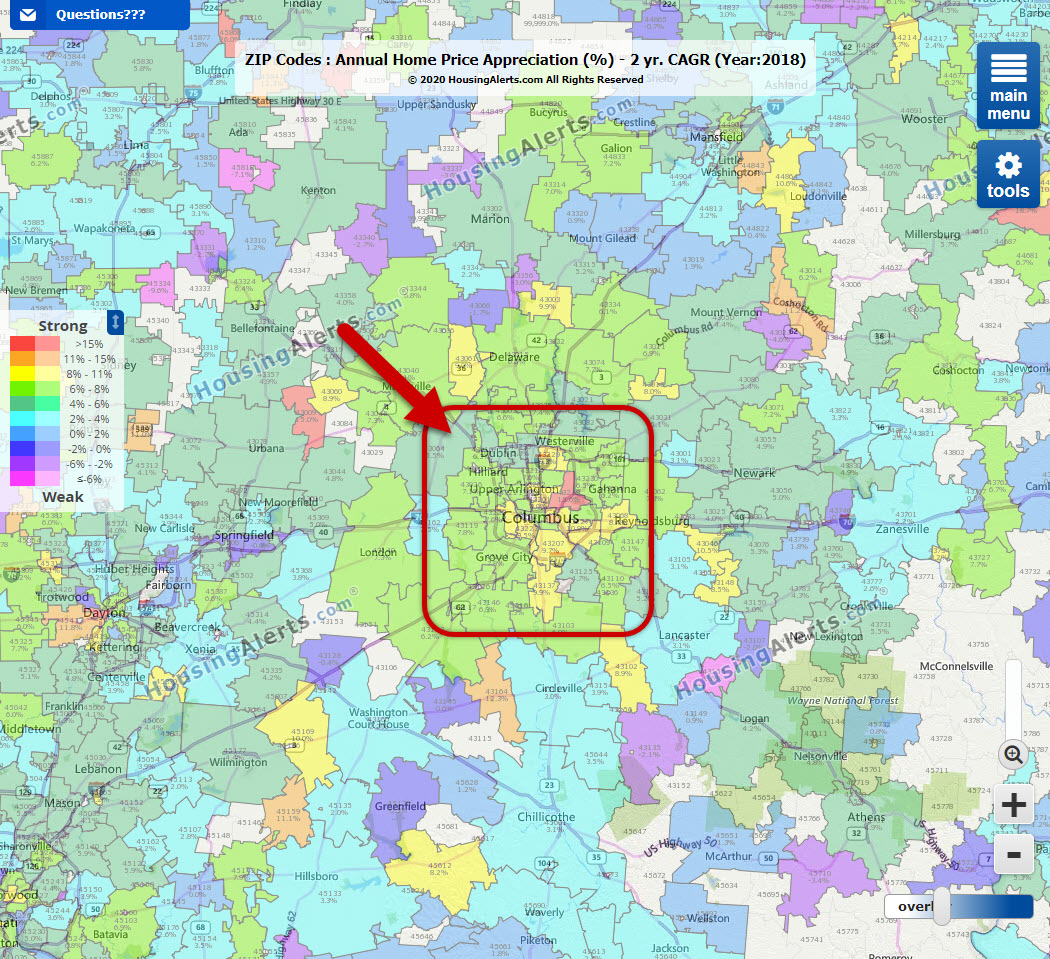

- Go to Metro Maps tool.

- Select ‘zip code’ and 2-Yr CAGR

- Zoom-in to desired level.

- Select ‘start’ year using drop down just below map

- Use “Map In Motion” buttons or manually flip through the years using the drop down menu.

- Scan for recent recurring ‘hot color’ zip codes

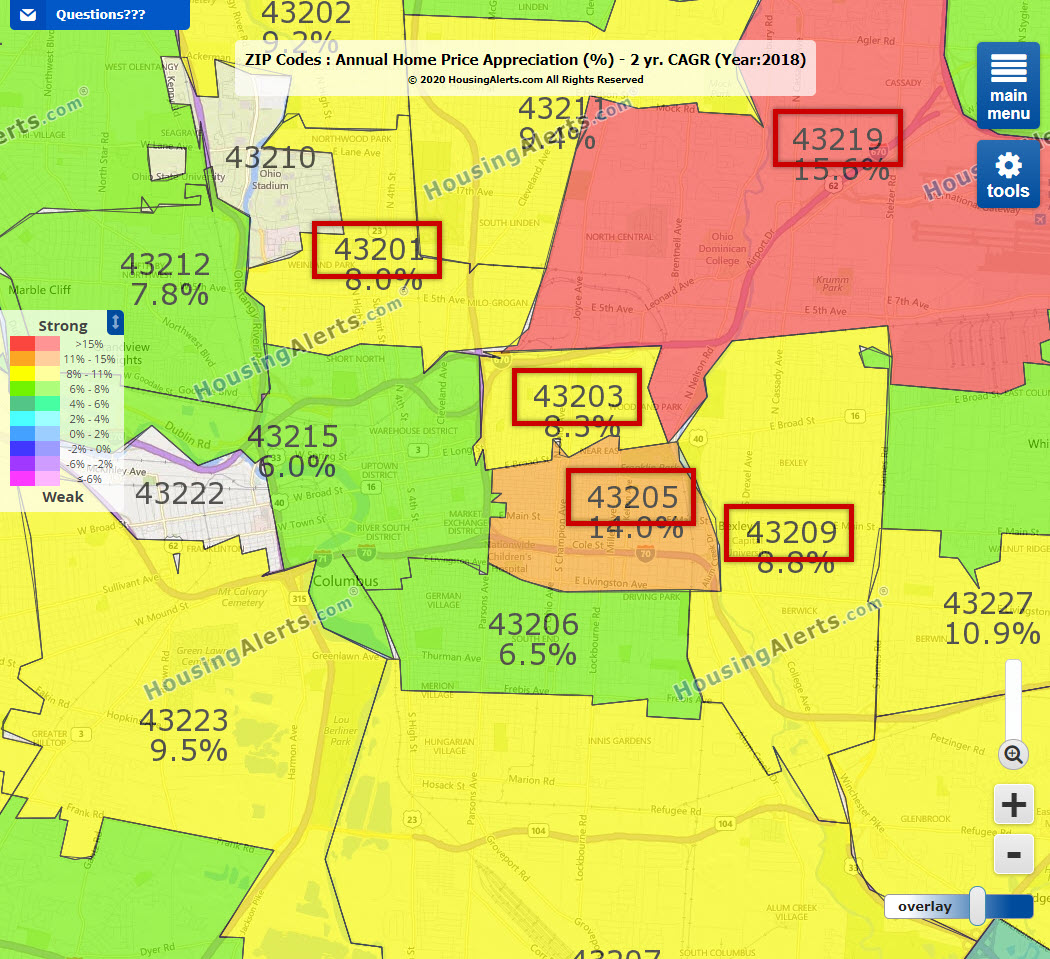

To illustrate, I saw Nashville TN is a hot market overall right now even though some nearby markets are not yet seeing the same upside surge.

After seeing that, I drilled down to Nashville’s zip codes – and there were a couple pockets close to the downtown area that looked relatively strong (red-ish colors rather than blue-ish) year after year.

Those zip codes are where I’d start if I decided on Nashville! (see 2 images below)

It’s also important to note that you shouldn’t be overly concerned about catching a market as soon as it enters a wealth phase or worry if it’s a few years into the cycle because the STAR indicators usually give very long lead times when a cycle starts reversing.

It’s more so a question of “What are your options?” – what other markets are at the top of your list?

A simple “Master Score” search using the STAR tool will give you a great list of top markets.

Grab your FREE State Account right now! Click here to start.